-Taking 5 Minutes may save you $1,000s of dollars

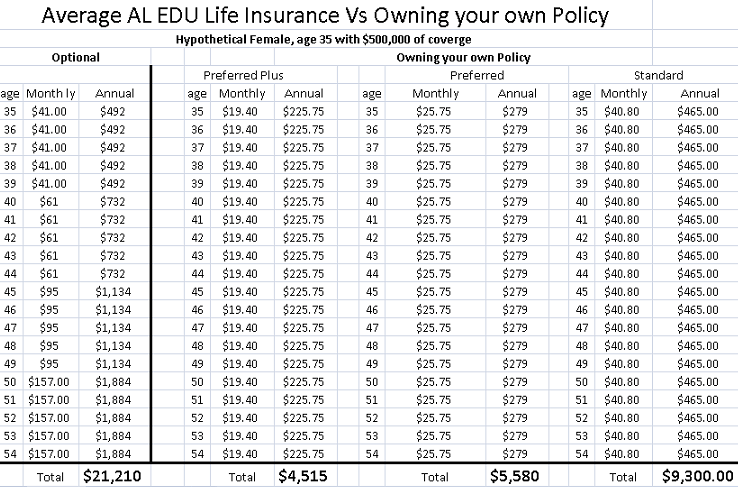

One of the most common questions I get from people is how much does my employer provided life insurance (and disability insurance) cost me compared to owning my own policy? I’ve done a great deal of work with employees from some of Birmingham’s largest employers including banks, hospitals and the power company all the way down to businesses with 3 employees and I can say that there are no two employee benefit plans alike! But, here a few good pointers that depending on where you work, may save you as much as 50-75% on your insurance premiums!

Take a moment and calculate your cost of coverage.

1. Know the cost of your insurance:

We’re not just talking about how much is being taken out of my paycheck but what is the cost of the insurance? A good way to determine the cost can many times be found in your employee benefits statement. If you haven’t looked at it in awhile, one quick phonecall to your HR rep will get you what you need. Some statements will give you a cost per $1000 in coverage. For example, it might say something like “.10 per $1000 in coverage.” So an employee with $500,000 in coverage is paying $50 per month for the insurance. Some costs are buried and little harder to determine. If you’re not given the cost up front, take the total premium subtracted from your paycheck and divide that by the amount of coverage you have. Be sure to multiply the premium by two if you’re paid twice per month.

2. Compare costs:

Most insurance carriers are going to place you into one of three categories based on their underwriting standards: Preferred plus or best, preferred and standard. Average costs for owning your policy: (prices based on female, age 35 with $500k in coverage for 20 years)

Preferred plus: .038 per $1000 in coverage

Preferred: .051 per $1000 in coverage

Standard: .079 per $1000 in coverage

How does your employer provided life insurance compare? If you’re a healthy person paying .10 per $1000 in your group plan, you could be paying half to almost a third of what you’re currently paying. Do you want to pay $50 every month or $19.40 every month for the same coverage?

3. Never assume that your company’s benefit is more affordable:

This goes for you CPAs as well who have what is probably the best group benefit in the corporate world. Don’t make the assumption that because you work for a fortune 500 company that they’re looking out for your wallet! Many times the larger corporations are choosing their benefits provider based on name or reputation as being HR friendly and not cost! Here in Birmingham, the two largest employers have some of the highest rates that I come across -in some cases over 4 times what you could be paying by owning your own policy! As for the CPAs who have their own group insurance trust, their premiums are untouchable……until they reach age 50 when the cost of insurance begins to increase rapidly every 5 years. For example, the average CPA, between ages 50 and 65 will pay more than double than the person who owns there own policy and close to triple the cost if he they decide to work till 70!

4. Always take what’s free:

Just about every employer provided life insurance plan will give you one to two years salary worth of coverage at no cost or medical exam to you. Free is good!

I’ve added a recent example of an appointment I had with a teacher in a school system South of Birmingham. The optional coverage had one rate across the board for every teacher in the system. Like many optional life insurance benefits, the premium goes up every 5 years. The average teacher in this school system will pay more than 4.5 times what they could be paying by owning their own policy! Even at standard rates, a teacher can save over $11,000 over a 20 year period! This example only went to age 54. If I included the cost of insurance for a teacher who retires at age 65, the cost of insurance goes so high that the average teacher can not afford to stay insured.

Cost of owning your own policy compared to the employer optional coverage.

So if you haven’t checked on your benefits in a while, make it a point to take five minutes and figure your cost of insurance. Those five minutes may just save you $1,000s of dollars!