Bundling Your Insurance to Save Money?

In the buying process, when companies are similar in financial strength, the decision many times comes down to premium amount. In an attempt at staying competitive, property and casualty (P&C) companies have all moved to “bundling” or giving discounts to policyholders with multiple policies. Bundling your insurance means the more policies you have with the same insurer, the more discounts you receive, or so the argument goes. (Remember you’re much less likely to leave your current agent if you have all your business with them.) As a broker, I have the ability to write life insurance policies with some P&C companies. I need to know my market and being able to quote with many carriers always gives me a competitive edge. But I’ve never written the first life insurance policy, term or permanent, with a property and casualty company because of price. Ever. The most competitive property and casualty companies will not make it into the top ten on my life insurance quotes.

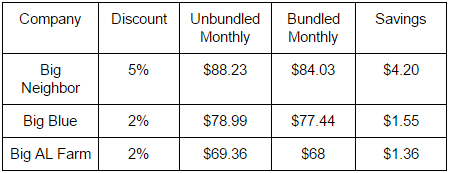

But do you save money by bundling your insurance such as your life insurance with your home and auto policies rather than using a reputable life insurance company? No. I’ll prove it to you. The following tables are quotes by what I referred to in part I of this article as, the Big Three: Big Hands, Big Neighbor and Big AL Farm. Each of the Big Three provide a bundled discount (not all P&C companies do). The way the discount works is by giving you a percentage off of your auto insurance — usually 2-5%. Remember though, the discount is only on your auto insurance. This is an important and often misunderstood point as you will never receive a discounted or bundled rate on your life insurance. So to make it a true “apples to apples” quote, they had to be able to quote both my life insurance and an auto to demonstrate the bundled discount. For the auto policy quote, I used a 2010, Toyota Sienna LE. For the life policy quote, I used a 41 year old male, seeking $500,000 in coverage for 20 years at preferred rates.

Auto Quote

Auto quote with bundled discount.

Auto quote with bundled discount.

Now, I know what you’re saying. You’re saying, “that’s it?” But pennies make dollars and I don’t mind saving any amount when it’s offered to me. Over the course of the year, the savings will add up (so long as you don’t mind paying an extra $10 a month for those of you with Big Neighbor). So what about the life insurance? I’m glad you asked:

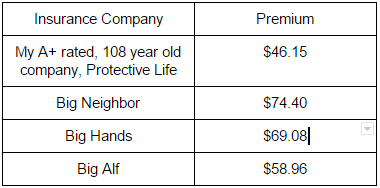

Life Insurance Quote Vs. Bundling Your Insurance

My life insurance rates vs. your auto agent’s rates.

Couple of thoughts before I get to the “all-in.” Big Alf is always the most competitive home & auto insurer I come across in terms of life insurance premiums. The word “competitive” is a relative term, however. I can generally come up with 10 carriers that will be a better value. Also, do you remember me saying that companies like niches? This is a good example as Big Alf is more competitive with men, but not so with women. If I were to reproduce this quote for a 41 year old female, they wouldn’t come close to the top ten. But all things being equal, if Big Alf is your carrier, you’d be better off than the other big companies for both auto and life.

It’s worth mentioning, too, that this isn’t a true “apples to apples” comparison. In part I of this article, we discussed that a reputable life insurance company’s underwriting requirements will many times be be more lenient than an auto insurer’s? For the purpose of this quote, I quoted everything as “preferred”, but the truth is, a percentage of people who would qualify for preferred rates with Protective Life will not qualify for preferred with the Big Three. They would end up with standard rates because their underwriting requirements are more stringent. You simply have a better chance for preferred rates with a life insurance company because they are many times more lenient in underwriting. Those who would unknowingly receive standard rates through their auto insurer, would pay another ~30% in premiums compared to someone with preferred rates at Protective Life.

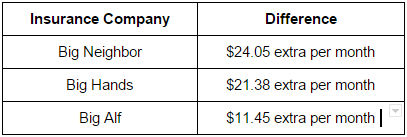

How Much You’re Paying in Extra Premiums Per Month

Difference in premiums including bundled discounts.

Summary

When I sit down with someone and do a cost analysis on insurance premiums, I make it a point to illustrate the difference in premium monthly, annually, and over the life of the policy. If we continue to pick on Big Neighbor in the life insurance comparison above; you’re paying an extra $24.05 monthly (assuming that Big Neighbor even offers preferred ratings). Over the course of the year, that works out to $288.60. Over the life of the policy, all things being equal, that works out to $5,772! How many decisions do you make every day that can potentially put thousands of dollars back into your pocket?

Each week, I attend a referral network with other professionals. It gives me a weekly platform to tell what I do and what makes me different. I frequently encourage people that their life insurance and savings will always be the foundation to financial planning. I also preach that the person who saves money each month in a disciplined, systematic manner will more often than not, out save someone who makes more but saves less. To have a better chance of saving money, you look for the best options everywhere you turn. We do this whether we’re buying groceries or finding someone to work on our house. If you can find a product or service for less money and not sacrifice quality, then it’s in your best interest to make a change. It’s the same principle with your life insurance — if you can save a good portion on your monthly premiums with a financially sound company, you stand a much greater chance to save money in the long-run.

How much can you save on your life insurance? Start here to calculate your monthly premiums.