Employer Provided Life Insurance

I do a great deal of work in Birmingham each year with life insurance for CPAs as well as employees who own the bulk of their life insurance through their employer provided option or the voluntary life insurance option. Most group benefits fall into one of two categories: 1. A benefit that goes up in price every five years and, 2. a benefit that is the same high rate for all employees whether you’re 25 or 55. Group benefits of the first variety tend to be very affordable for younger employees and gradually increases as the employee ages. Option 2 uses a unisex rate for all employees of all ages and may be affordable for older employees who aren’t in good health. Generally speaking, if you’re older than 30, you need to shop your insurance! The average person at age 30 can get a better rate on the open market. My previous post on teacher group rates is a good example of this.

Group Life Insurance for CPAs

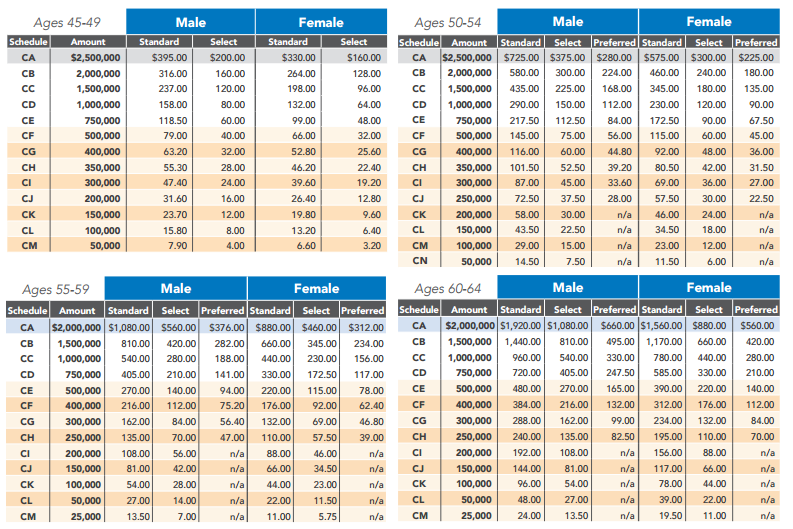

Very seldom do I come across a group benefit that is competitively priced for holders of the insurance. That is unless you are a CPA. The group life benefit for CPAs is the most competitive benefit I’ve come across in the business world to date. For the majority of a CPA’s professional career, they can expect to pay better than market prices for their life insurance. Why? One, rates are very competitive for younger employees due to low mortality. The big reason though for the low cost of coverage is due to the trust reimbursement. Each year, the life insurance trust pays back its members the excess of administration and mortality expenses. So, generally speaking, CPAs can save a great deal of money on their premiums …….. UNTIL the CPA turns age 50. Prudential Life, the company who underwrites the group benefit for CPAs has built the insurance to gradually increase in cost as the CPA ages. In fact, another reason for the low cost of coverage for younger CPAs is that older CPAs are baring a majority of the cost. In fact, the CPA with standard rates will experience a 43% increase at age 50, a 48% increase in cost from age 55 and another 44% at age 60! Let me say that again, a 50 year old, female CPA paying standard rates will see their cost of insurance increase by 135% within ten years! Why? Well, if you’re an insurance company, you enjoy getting paid premiums but don’t enjoy paying out death claims! So the cost of insurance is built with draconian increases to cause CPAs to either drop the face amount or pay significantly more for increased mortality. If you’re a male CPA reading this, don’t feel left out as your cost of insurance goes up by a similar percentage.

Cost of insurance compliments of cpai.com

Cost of insurance compliments of cpai.com

Owning Your Life Insurance Vs The Group Benefit

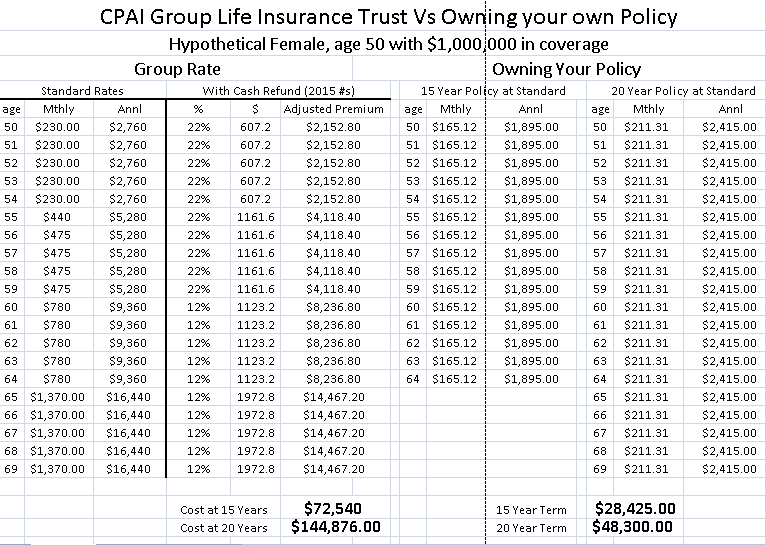

The comparison provided below is a recent client of mine; a local, Birmingham CPA, female and current age 50. Based upon her health and having spoken with a number of underwriters, I feel very strongly that she will be standard with most insurance companies. Even at standard rates and assuming that she retires at the normal retirement age of 65, this CPA will save a whopping $44,000 over the course of the next 15 years! Every year the CPA continues to work past 65, they will have to fork out over $16,000 per year for the same amount of coverage when it could be costing them just over $2,400 per year. How many decisions will you make today that will put $44,000 back into your pocket?

If you’re a CPA with the CPAI group benefit, kudos on you for having an excellent benefit throughout most of your working career. Hopefully you set that money aside and made it work for you. But if you’re in your 50s or have recently turned 50, it’s time to talk.

Comparison quoted at standard rates for a female, age 50.

Comparison quoted at standard rates for a female, age 50.